The Role of a CFO: motivating people, managing assets and hedging risks

- -

- 100%

- +

Preface

I’ve penned this book for financial managers, whether they’re novices or seasoned professionals, as well as financial directors, entrepreneurs, CEOs, COOs, board members, and anyone seeking to establish effective financial management practices in both business and personal realms. The aim is to elucidate how to build a flexible, agile management system suitable for a rapidly expanding company in today’s competitive and ever-changing world.

What prompted me to write this book? I frequently field inquiries about establishing various financial processes within modern organizations, aiming for minimal bureaucracy, maximal humanity, simplicity, and logic. The challenge lies in achieving these goals without stifling employees’ entrepreneurial aspirations while ensuring adherence to control procedures and meeting the company’s commitments.

Many individuals seek recommendations for a book that caters to a wide range, from entry-level financial specialists to directors accustomed to traditional business practices, particularly those operating outside digital companies within vertically managed hierarchical structures reminiscent of the previous century. Such a book should resonate with traditional leaders and entrepreneurs, showcasing the benefits and opportunities for gradual transformation without dismissing modern management practices, which could appear potentially risky. It should delve into financial management within the context of today’s highly competitive, digital, and rapidly evolving global economy.

Yet, despite my search, I’ve been unable to find such a book, whether in English or Russian (my native language). In my view, the rapidly evolving management landscape has created a chasm between academic texts on financial management and practical guides on organizing financial processes.

Theoretical texts containing academic foundations often stray far from day-to-day practicalities, appearing outdated and out of touch with the real needs of financial management in modern companies. They’re academic in nature, characterized by dry language, and fail to align with the goals and objectives of growing modern companies.

In contrast to academic books, there are numerous educational courses, guides, and recommendations available on organizing various financial management processes. However, delving into these scattered sources often results in fragmentation and a lack of a holistic view of company management processes. Establishing specific financial procedures devoid of consideration for overall business processes, organizational history, complexity and strategic focus typically leads to inefficient resource utilization, time wastage and, ultimately, the loss of strategic competitive advantage.

These factors, combined with my desire to comprehensively address the topic and share current expert knowledge, spurred me to create this book. I write prolifically and maintain a blog on financial management, motivation and efficiency[1]; I have much to share. But before delving into the content, allow me to talk a bit about my background.

I’ve spent over 14 years working in Russia, seven in the Netherlands and Luxembourg, and since 2022 I’ve been based in the UAE. Since 2016 I’ve spearheaded the development of financial and operational processes in technology companies, serving as a Chief Financial Officer (CFO) with extensive responsibilities. This experience has been invaluable. My journey to the role of senior financial manager in a company has been shaped by my experience in banking and entrepreneurship.

I embarked on my career in corporate banking while still a fourth-year university student, joining International Moscow Bank (IMB) in a department responsible for attracting and servicing large corporate clients. Just to mention, when IMB was established in 1989 it was the first international bank in the Soviet Union, and counted top-tier European and Asian banking conglomerates among its shareholders. When I started at IMB in 2003, my clients hailed from the pulp and paper industry, wood processing, and various mechanical engineering sectors. My first major project involved arranging long-term project financing for the acquisition of a plywood plant in the Kostroma region.

Working as a corporate banker entails navigating a blend of politics, networking, and financial analysis. Key to success in this role is the ability and willingness to negotiate with people who have divergent interests. Typically, these are formidable negotiators, as well as being ambitious and self-assured professionals. Banking served as an excellent training ground for a novice specialist like myself. I spent roughly a decade in banking, four of which were in Europe. During this time, I provided various types of loans to major CIS companies, spanning trade and working capital financing, syndications and intricately structured loans for constructing new factories and acquiring competitors.

By the late 2000s, it became evident to me that the banking industry would undergo contraction and consolidation, leaving many specialists unemployed. As someone who harbored aspirations of entrepreneurship and desired a shift from banking to production or service provision, I took the risk of becoming self-employed.

In 2011, I launched my own company specializing in corporate finance consulting, knowing that I could draw on a decade of experience working in major international banks, developing projects, and engaging in B2B sales. These experiences helped me to build a successful business with clients across CIS and European countries, which continued to thrive until the end of 2015. Unfortunately, geopolitical events led to the cooling of relations between the EU and Russia, coupled with significant reductions and even the end of financing for businesses from CIS countries by most European and major international banks, resulting in the closure of my company.

In 2016 I returned to employment, this time as a senior financial manager (previously, as a consultant, I had worked more as an advisory CFO or type of financial advisor to the CEO or owner). For four years, besides supervising legal and some other departments in the position of CFO, I led the financial department and oversaw operations and development in a crowdsourcing logistics project spanning more than ten countries. Together with its CEO, we visited the largest and fastest-growing metropolises in the world and settled companies from Turkey to Brazil, launching operations within just a few weeks upon each visit. Subsequently, in early 2020, I transitioned to work for a leading financial marketplace. Alongside setting up financial management from scratch and formalizing and automating financial and operational processes, my primary goal was to prepare the company for an IPO on NASDAQ. Once again, a «black swan» occurred – while geopolitical events thwarted our main objective, the experience presented valuable challenges and the opportunity to work with an exceptional team I managed to assemble in the company, particularly in the finance department.

In mid-2022 I returned to the international business arena, currently leading the finance and legal departments, and overseeing operations in an international team of highly talented software developers and mathematicians engaged in algorithmic trading. We confront new ambitious challenges amidst the changing economic landscape.

Wrapping up my introduction, I’d like to highlight my enduring passion for learning, conducting analytical work, dealing with vast and fragmented datasets, and optimizing processes while assisting colleagues, and imparting knowledge to employees. In addition to corporate careers in banking and finance, I completed my dissertation in economics (equivalent to a Ph.D.) at the Institute of Economics of the Russian Academy of Sciences in 2015.

My current professional interests revolve around establishing flexible and sustainable financial and operational management in technological businesses, international development, automation of operations, and corporate finance topics. I hope that the experiences I have shared in this book will prove valuable to you and your companies, aiding in the creation of a team of likeminded individuals passionate about their work in a conducive corporate atmosphere. Above all, I aim to guide you, your colleagues, stakeholders, and your company to which you dedicate a significant part of your life, steering you on a path of development and improvement toward ambitious goals shared passionately by all involved parties.

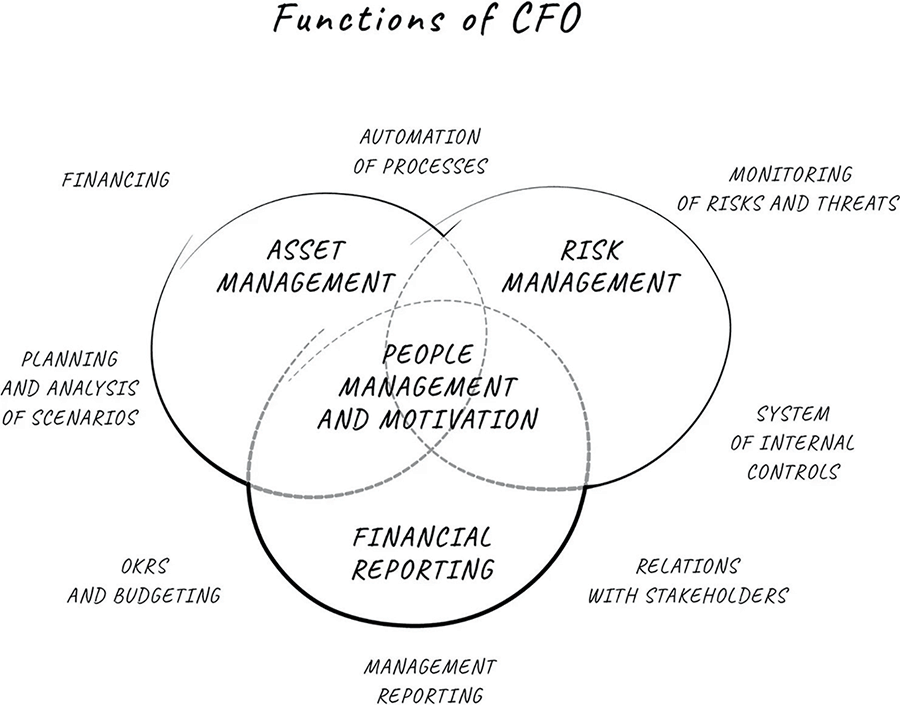

Now, let’s turn to the theme and structure of the book. I’ve broken it down into ten chapters, each exploring the four key components of a financial leader’s work: people management, decision support, asset management, and risk control. However, it cannot be said that the first two or three chapters exclusively address HR issues, while the few subsequent chapters discuss decision-making, and so on. In reality, all chapters to a greater or lesser extent touch on issues related to these four components of the financial director’s activities. Traditionally, the finance department is considered a provider of information for management reporting, which, in turn, is essential for decision-making. Additionally, information from the management accounting system is used in preparing financial statements required for tax reporting and interaction with government authorities. Indeed, this is a significant but no longer the primary activity of financial professionals – as discussed in chapters on people management and motivation, working with shareholders and investors, and, of course, the chapter on decision support.

When talking about financial management, I primarily mean the efficient usage of one company’s resources through employee management and their motivation towards achieving common goals. This forms the core theme of the book, reflected in the title’s emphasis on «people» over «money». I firmly believe that employees are paramount, placing them above financial resources. Consequently, the theme of personnel management and motivation serves as the foundation for each chapter.

Asset management and risk controls are equally critical themes addressed in the book, permeating all aspects of a financial leader’s responsibilities. Given that finances constitute a company’s primary assets, risk control and threat prevention take precedence for financial directors. While the importance of both areas hardly needs affirmation, recent events like the COVID-19 pandemic, military conflicts, and sanctions against whole countries and specific businesses have underscored the superiority of these responsibilities, drawing the attention of company owners, boards of directors, executives, and financial professionals.

Here, when I refer to «financial professionals» I’m encompassing not only analysts and economists but also accounting staff, internal controls, ERP developers, methodologists, tax specialists, HR professionals, contract management specialists, and those involved in external document flow management, as well as lawyers. This broad spectrum of professionals provides internal service support for business operations. The exception, perhaps, would be network engineers and other IT professionals, although historically in Europe and the United States oversight of the IT department has often fallen under the CFO’s purview.

In this book, the financial department is viewed as a financial-operational unit facilitating the execution of the majority of functions related to operational digital infrastructure, decision support, organization of data collection, as well as preparation, and delivery of various reports through BI infrastructure, document management, liquidity management, internal controls, risk management, and much more.

While some may label this as the back office, I find such a definition overlooks contemporary business demands for flexibility, speed, and result-oriented motivation. My aim is to provide competitive and qualitative internal and external service functions necessary for the successful and most comfortable conduct of business and the support of commercial operations.

Therefore, the internal financial-operational service (client-centric, understanding business processes, oriented toward quality results) I establish in each company focuses not only on transaction processing, report preparation, and backing up the commercial function, but also on strategically ensuring the continuous functioning of the business, supporting its stable and predictable development.

Many companies lack a strategic approach to operations and finance management, as well as a service-oriented, modern, harmonious focus on comprehensive development and consideration of the interests of all parties while remaining customer-oriented. By prioritizing these goals, you can plan the transition to a new stage of personal and company development, identifying the essentials in the organization’s activities, and preparing for the future accordingly. This book will assist you in meeting these challenges.

Introduction

Why is financial management necessary? I open this book with a seemingly paradoxical question. While the answer may appear self-evident, in practice it’s not always so.

I’ve encountered and continue to meet senior managers and entrepreneurs who genuinely believe that financial management isn’t crucial for building a successful company. This perspective is flawed. Many operate under the misconception that finding the right idea, crafting a business model, negotiating with counterparts and assembling an operational team negate the need for managing finances, at least during the initial years of a company’s existence and, often, not even in the first decade.

I’m convinced that this mindset is a relic of the post-Soviet management model. Those familiar with that bureaucratic system became exhausted by planning but never truly grasped the intricacies of sound financial calculation and organized budgeting. In that environment, where competition was scarce and profitability often obscured financial scrutiny, there was little impetus for implementing robust financial management: competition was absent, and the profitability was such that money was not counted. Additionally, the explosive economic growth and lack of competition in various sectors were periodically disrupted by crises and currency devaluations. The absence of crisis management experience hindered the development of economic planning habits and systematic financial management for most economists.

During the first two decades of Russia’s market economy development, profitability, often achieved through unofficial financial schemes and legal structures for tax optimization, served as the primary yardstick for financial management effectiveness. The ability to negotiate financing with banks and other financial institutions was deemed a critical skill for financial managers. Meanwhile, factors like the quality and depth of management accounting and reporting, effective liquidity management, internal process organization and automation, and the implementation of transparent internal control systems – parameters widely accepted as key indicators of financial director effectiveness in Europe and North America – were deemed inconsequential, and sometimes even detrimental, to the businesses grown on the former Soviet grounds.

Few would dispute the notion that a commercial enterprise must strive for financial independence in the foreseeable future. Even in the case of esteemed yet loss-making companies, particularly in the technology sector, eventual profitability and steady, sustainable growth over a predictable period are pivotal factors in determining a company’s value. And achieving this is inconceivable without competent financial management.

During the first two decades of market reforms, Russian enterprises’ senior management displayed little interest in establishing effective financial management practices. Similarly, most entrepreneurs remained indifferent due to either shortsightedness or tacit approval from their enterprise’s leadership. It sounds unbelievable, doesn’t it? Yet, that’s precisely how it was, and several factors contributed to this apathy.

Why bother constructing a transparent automated internal control system when tax authorities could effortlessly uncover illegal tax optimization methods through it? Why adopt long-term budgeting and forecasting systems when top-managers found it expedient to base decisions on situational assessments, believing that high results and substantial profits were a result of their foresight, while failures were attributed to the inability to plan effectively amidst Russian instability? Why overhaul the mindset and motivation of midlevel managers to adopt a customer-oriented, competitive service approach when, for the past two decades, the prevailing approach had sufficed, and retrained managers might simply leave to establish competing businesses?

So, why is it unfathomable to envisage building a business without financial management? Even in companies lacking a designated financial manager, fund movement is regulated, albeit perhaps based on common sense rather than specialist intervention. Failure to manage finances can swiftly precipitate business collapse: «sudden» cash shortages, employee demotivation due to non-payment of obligations, counterparties refusing cooperation due to payment defaults, fines and tax authority audits, fraud, and managerial errors in a competitive environment.

You may wonder how many companies and entrepreneurs have succeeded in building prosperous businesses without regular financial management. Here, the infamous survivorship bias comes into play. While we’re familiar with success stories, we often overlook the percentage of new businesses that perish en route to achieving their objectives, as well as the factors influencing their survival. Experienced investment managers recognize that in a burgeoning market, anyone can turn a profit, but in a stagnant or declining market, only a select few prevail. Unlike the «fat years» of explosive growth when mediocre managers could easily run companies, in times of crisis and stagnation business survival hinges on well-prepared processes, managerial acumen, and entrepreneurial skill. This is within reach of only a privileged few – the most successful and fortunate companies. Nevertheless, effective organizational management, comprising technical tools alongside the right corporate culture – data-driven planning, process organization, technology application and automation, team selection, a strategic decision-making approach, and motivation – are the cornerstones of regular management.

What distinguishes common sense from professionally constructed management? The former occasionally falters, and the absence of a dedicated finance manager can lead to the absence of management accounting and the emergence of strategic risks. Another significant risk factor is that the longer a company evolves and internal processes develop without a corresponding specialist, the more challenging (and painful) it becomes to restructure these processes in the future and transition to regular financial management.

Any sustainable business hinges on timely financial decision-making. In broad terms, this encompasses everything that determines its health and longterm entrepreneurial success: accurate assessment of business opportunities, efficient resource utilization (not solely financial), timely engagement in specific projects considering prevailing and anticipated economic conditions, partner and employee selection, motivation, and much more.

Upon conceiving an entrepreneurial idea, financial management becomes imperative: one must assess possibilities, calculate required resources for realization, and evaluate associated risks. Even in daily life, financial management permeates all activities. Each of us engages in numerous iterations daily, choosing products at the supermarket, evaluating the option of using a taxi instead of the subway, weighing the risks of purchasing cheaper goods or services, and devising expenditure plans for significant purchases. A closer examination reveals that our routine decisions adhere to basic financial management principles, intuitively embracing budgeting to achieve tactical and strategic life goals. The same applies to businesses: all financial processes demand structure and streamlining.

In financial management, several key components can be identified and, based on them, all financial tasks can be conditionally categorized into four blocks: personnel management, providing management and external users with decision-making information, asset management, and risk management. Why «conditionally»? Because these blocks are interconnected. Personnel management and motivation form the bedrock of all management processes, while risk management entails integrating control points and procedures into nearly all processes influencing financial management. Providing decision-making information essentially serves as the instrument panel for management, empowering the allocation of an organization’s assets.

People management stands as the linchpin of any collective endeavor, determining both successes and failures. Broadly speaking, even individual resource management can be efficiently structured under the encompassing concept of resource management applicable to group management. The essence of any manager’s role lies in the efficient utilization of resources. In modern business, people are recognized as the primary resource, maximizing added value in most countries. Hence, I accord precedence to personnel management: searching, hiring, motivating, and orchestrating the effective deployment of talent.

Subsequently, specific aspects relevant to financial management are addressed. It’s noteworthy that financial management significantly relies on in-depth knowledge of production (operational) business processes, legal functions and compliance expertise, understanding of the company’s technological infrastructure, familiarity with business marketing channels, and more – all of which impact managerial decision-making. However, for the scope of this discussion, emphasis will be placed on financial management, so I will thoroughly examine the key areas of financial management while others will be mentioned in passing.

Thus, the first financial block within the company management system to be explored is financial and operational reporting for decision-making by both external and internal users. This encompasses tax reporting for government authorities and consolidated reporting per international standards. The latter is essential for internal users (management and shareholders) and external users (tax authorities, potential investors, banks, and other interested parties) alike.

The second block involves asset management in a broad sense, encompassing the management of available internal and external resources, process organization, and business efficiency improvement. Asset management extends to activities such as optimal supplier selection. Furthermore, in recent years, possessing a strong banking history has become a highly valuable asset, particularly for international business operations and ownership of companies in multiple countries. Opening and maintaining bank accounts in the modern, fragmented, and sanction-limited banking landscape demands considerable expertise and sustained investment in relationships.

Lastly among the key financial leadership tasks is risk management: establishing internal controls to enhance business efficiency and mitigate situations where employees abuse their authority, whether intentionally or inadvertently. This includes the classic understanding of the control environment outlined in manuals for international financial reporting standards: corporate-level controls, information system controls (or IT controls), as well as financial controls.

Together, these delineated blocks constitute a complex network of interconnected elements of financial management. Ensuring proper process configuration, facilitating information exchanges, synchronizing participant actions, and implementing timely and adequate automation – these are all hallmarks of competent financial management and serve as essential prerequisites for the development of any business, whether they are commercial or non-commercial ventures.